How Auto Insurance Bias Might Affect You

Rates for car insurance vary from person to person. Typically, factors like annual mileage, car make and model, age, driving record, marital status, and even gender make a difference. All of this is based on extensive research for insurance companies to get the most bang for their buck. But as with most things in life, auto insurance bias has a life of its own.

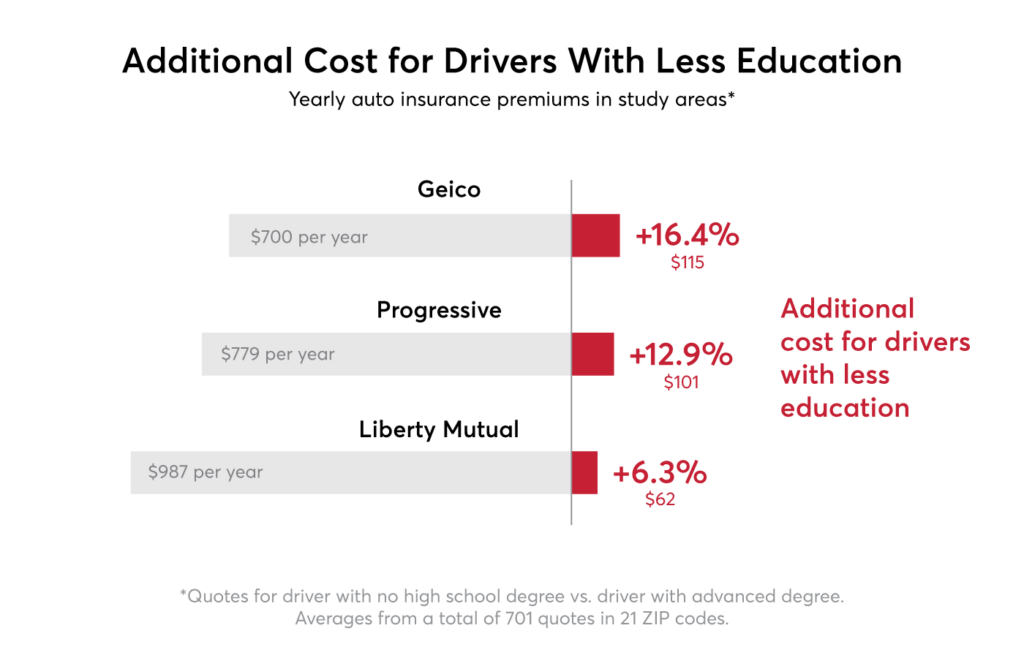

Education is a part of auto insurance bias, according to Consumer Reports

Believe it or not, insurance companies providing auto policies have historically charged high premiums for people with less education. This can be seen in the numbers, which show that Geico charges as much as 16.4% (or $115) more for those with less education. Similarly, Progressive charges 12.9% (or $101) more while Liberty Mutual charges 6.3% (or $62) more.

Image Source: Consumer Reports

It’s not just numbers that declare this disparity. It’s people, too. Consumer Reports featured one woman, Cuqui Rivera, who was able to save $1,800 annually by switching to an insurance company that didn’t factor in education as a premium consideration. Rivera ended up going with Citizens United Reciprocal Exchange (CURE), a not-for-profit insurance company operating in the mid-Atlantic region of the US.

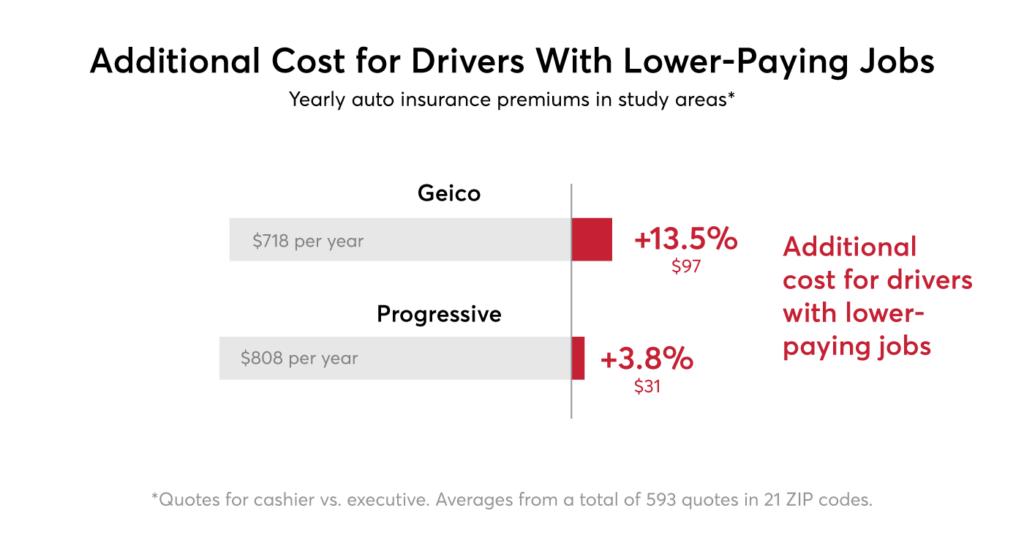

Job title and financial standing both play a part in the equation

A more prestigious job title (in the eyes of society) is likely to induce a lower car insurance premium. On the contrary, a working-class job title may dent your standing enough to tack onto the premium.

Image Source: Consumer Reports

Additionally, insurers will weigh your fiscal health, including whether you rent or own your home, and what your credit score is. This can feel unfair, particularly for those who’ve been economically impacted by the COVID-19 pandemic.

“No one should have to pay a penny more for auto insurance just because they haven’t graduated from college or have a working-class job.” – Chuck Bell, Consumer Reports policy advocate

The NIMBY consideration for auto insurance bias

Zip code plays a role in car insurance premiums, which can be problematic particularly considering historical zoning practices that delineate between class and race. The not-in-my-backyard (NIMBY) effect, including redlining and gerrymandering, both come into play here. Yes, city residents tend to be more likely to get into auto collisions based on population density, but the urbanization of certain minorities puts a catch 22 onto inner city residents that they are unable to avoid.

Auto insurance bias in the US shouldn’t be surprising. Lending and coverage in the country has a freckled past, and it makes sense that this would carry into the modern day. But the onus to pay more should not rest on the individual, particularly due to their level of education, job title, and location (especially when that location is a low-income zip code). Even age and gender are biographical details that we can’t control.

How to address auto insurance bias is beyond me—but knowing what’s going on behind the curtain is a good way to start the conversation. The National Association of Insurance Commissioners announced in 2020 they were beginning to study potential auto insurance bias and discrimination. Results are expected this year.

Its very unfair for them to factor in things unrelated to driving like education and work. They should stick to age and experience.

I didn’t know so much went into my car insurance! It is definitely good to know.

This is insane. I understand your driving history and age, but those are the only things that should have an impact. I have seen my insurance go up each time I move. And it feels backwards that a lower paying job means you should pay more to drive your car. Quite outraged.

Wow! I didn’t know all of this. That is an unfair way to charge people for auto insurance. I can almost even call it a scam. I understand zip code and even where you may live being a factor because accidents maybe higher in a person’s area, but whether or not you went to college and what you do for a living should never be a reason to over charge someone. People are barely making it by as it is. Disgusting.

Check out GABI, to see if you are eligible for any type of discounted rates.

This is crazy!