7 Costly Mistakes Car Lessees Make Without Realizing It

Leasing a car can be an appealing option, allowing you to drive a new vehicle every few years while avoiding the commitment of an outright purchase. However, car lessees often unknowingly make mistakes that can end up costing them dearly. In this post, we’ll explore seven common pitfalls that car lessees should avoid to protect their interests and steer clear of unnecessary expenses.

Common mistakes car lessees make

Underestimating mileage needs

Most lease agreements have strict annual mileage limits, and exceeding them can result in hefty charges per excess mile driven. Underestimating your driving needs can quickly turn your lease into an expensive endeavor.

Neglecting to understand the money factor and fees

The money factor (similar to an interest rate) and various fees, such as acquisition fees and disposition fees, can significantly impact the overall cost of your lease. Failing to understand these factors can lead to unpleasant surprises down the road.

Overlooking wear and tear guidelines

Leased vehicles must be returned in a specific condition, with normal wear and tear allowed within certain limits. Excessive wear and tear, such as dents, scratches, or damaged interiors, can result in costly penalties at the end of the lease term.

Modifying the vehicle without approval

Making unauthorized modifications or alterations to the leased vehicle, such as tinting windows or installing aftermarket parts, can be a violation of the lease agreement and may result in charges or penalties.

Disregarding maintenance requirements

Lessees are typically responsible for maintaining the leased vehicle according to the manufacturer’s recommended schedule. Neglecting routine maintenance can void the warranty and lead to costly repairs or potential penalties.

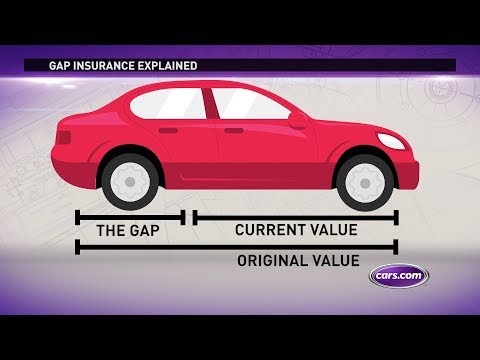

Ignoring gap insurance

Gap insurance covers the difference between the car’s value and the remaining lease balance if the vehicle is totaled or stolen. Failing to obtain gap insurance can leave you financially responsible for the remaining lease payments.

Terminating the lease early without understanding the consequences

Many lease agreements have strict policies and penalties for early termination. Failing to understand the terms and conditions can result in substantial fees or even being required to pay the remaining lease balance in full.

Takeaways

At the end of the day, a modest investment of effort in learning yields a tremendous return. It’s the key to unlocking significant savings while avoiding roadblocks and detours that drain your wallet and sanity. So buckle up, study up, and get leasing savvy! Your future lessee self (and bank account) will be immensely grateful.