Startup Gabi Helps Drivers ‘Get a Better Insurance’

There’s something to be said about an established company. After all, they’ve managed to stay relevant through the years. But startups have the advantage of resolving today’s unique problems from the outset. In the car insurance world, Gabi insurance finder is one of them.

What to know about Gabi insurance solutions

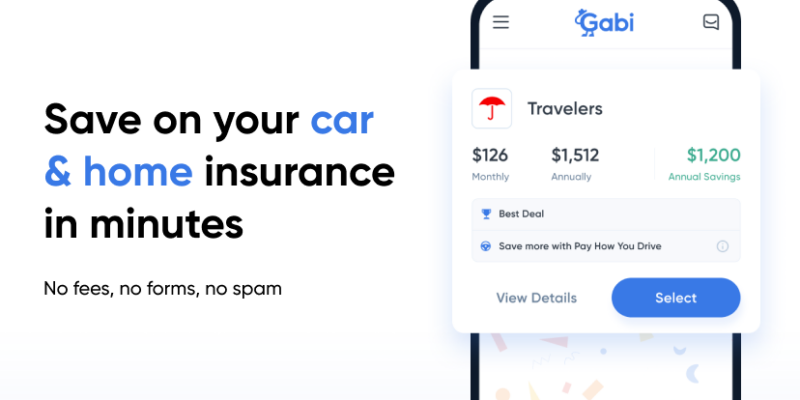

Gabi is a licensed insurance broker in all 50 US states. Their free car insurance comparison tool helps drivers sift between different options, which ultimately helps them save money. It’s more than just cost comparison, though. You can weigh the features across different options, too.

Gabi slings various insurance types, including auto, home and renter’s insurance. Founded in 2016 by San Franciscan techy Hanno Fichtner, the company has come a long way.

Are you saving as much money on your home and auto insurance as you could?

Here’s how to decide if combining home and auto insurance is right for you (and how to find the best deal):https://t.co/gvXjc117sm#insurance #autoinsurance #homeinsurance #finance #money #MoneyTips pic.twitter.com/nogfepvMG6

— Gabi (@Gabi_Insurance) February 4, 2021

Does it really help you ‘get a better insurance’ or is it all talk?

Gabi literally stands for “get a better insurance.” Does the company actually live up to the name?

According to Gabi, the platform helps 70 percent of users find savings. It’s clearly not foolproof, but that’s a high enough metric to keep their audience growing. Since it’s free to drivers (the car insurance companies are the ones paying the price every time someone purchases a plan through Gabi), the average $961 in annual savings goes far.

Interesting features of Gabi insurance finder

Gabi lets you link your current insurance plans to make sure you’re not missing out on any deals right now. The platform works in mere minutes and it doesn’t require you to fill out a complex form before delivering results.

Even those without current insurance are still able to get a quote, which helps with equity in the insurance world. The fact that you only need your name, birth date, email address, home address and phone number means most people (except the unhoused) can use it. Plus, the user friendliness means you can get your elders on the Gabi insurance finder, too.

What are the cons of this car insurance comparison tool?

Gabi does require a signup, which means you can’t just peruse the options without providing your information. Despite a focus on privacy, they’re not perfect. Email address and phone number privacy in particular is a huge problem. You can reach out to the customer service team via a live chat, but it may not be as quick as you’d like.

One of the most popular competitors to Gabi is Lemonade Insurance, so it’s not the only player in the game. However, this startup may be a good option for people seeking savings and features on their auto insurance or other types of protection.